Human Subject Payments, How to Pay

Definition

Human subject payments are defined as payments of cash (including cash equivalents/gift cards) or tangible personal property as incentives to individuals (subjects) for their participation and time commitment in a clinical trial, survey, or research study. Please refer to the Office of Research Protections and Integrity (ORPI) Human Subjects webpage for detailed requirements for research studies that involve human subjects at UNC Charlotte.

Payment Methods

49er Mart or purchasing cards (p-cards): Can be used to purchase any items of tangible personal property, such as pens, books, candy. P-cards can be used to purchase gift cards. (refer to the Gift Cards/Gift Certificates, How to Pay guide; link in the table below). Note that gift cards are considered cash equivalents. Electronic check requests (eCRs) can also be used to issue payment directly to a recipient who is not a student or employee. The recipient must be set up as a vendor before initiating the eCR.

Petty cash: May be used for payments up to $100 per individual, per study.

- To open a petty cash fund for a specific research study, complete a Petty Cash Fund Request Form, which must be approved by the Office of Research Protections and Integrity (ORPI) before being routed to the General Accounting office for approval. ORPI will confirm that cash was listed as the compensation method on the study’s approved IRB proposal.

- Petty cash for research studies must be initially funded through a non-grant fund (as grant funds cannot be used for advances, including to advance petty cash). Once the research study is complete and petty cash is no longer needed, the department must complete a Petty Cash Fund Request Form to close the fund. Once the petty cash fund is closed, any petty cash used for the research study can be reimbursed via grant funds by submitting a reimbursement request via an FTR form. For questions about this process, please contact Grants & Contracts Administration.

- Petty Cash Custodians must review the Petty Cash/Change Fund Procedures prior to receiving a petty cash fund. Note that reconciliation of funds is required to be sent to the General Accounting office on a monthly basis.

- Petty cash funds can have a maximum balance of $5,000. Any requests for more than $5,000 must be approved by the Vice Chancellor for Research or delegate and the University Controller.

- Requests for amounts greater than $250 should be sent at least five (5) business days in advance to allow time for the cash on hand to be requested.

Employee/Student Direct Pay Request (ESDPR): May be used when a check/direct deposit to an employee or student recipient is desired. Download an ESDPR form and complete according to the form instructions. Note that payments must be issued directly to the recipient; cash cannot be issued to administrative personnel for further distribution.

Rationale and Other Considerations

Regardless of the payment method chosen, tax reporting requirements must be met:

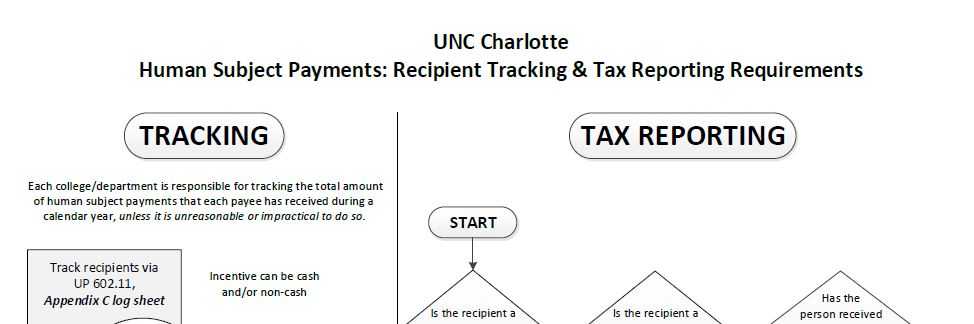

- Each college/department is responsible for tracking the total amount of human subject payments that each payee has received during a calendar year unless it is unreasonable or impractical to do so.

- Refer to the flowchart below for tax reporting required depending on the target study population, incentive amount, and recipient classification. Recipient classification information is also summarized below.

Click on the image below to enlarge:

Recipient classification and Tax Reporting Requirements:

- Employees: All cash incentives, including gift cards, of any amount given to employees (including student employees) are reportable on the employee’s Form W-2 and subject to federal and state income taxes.

- If UNC Charlotte employees are targeted in the research study, then any cash incentives (including gift cards) given to employees are taxable/tax reportable to the recipients as employees, regardless of amount.

- If the target study population is NOT specifically UNC Charlotte employees, nor is it advertised directly to UNC Charlotte employees by themselves, then incentives paid can be considered as unrelated to the recipient’s employment at UNC Charlotte. If the principal investigators (PI)/research administrators will not be checking recipient status (employee v. non-employee), to mitigate risk, these incentives should be limited to $100 or less. Payments are subject to the non-employee reporting requirements.

- Non-employees: If combined payments to a non-employee total $600 or greater in a calendar year, the total amount given is reportable on Form 1099-MISC reporting.

- Foreign nationals: Prior to making a payment of any amount to a foreign national/non-U.S. resident, contact the Tax Office, as tax reporting (on Form 1042-S) and withholding are required.

Quick Links

Policies

Forms

Questions?

Refer to the Tax Office and the Office of Research Protections and Integrity contacts.

Last updated: 5/02/2018, 7/30/19, 8/5/19, 7/01/21, 10/22/24

Last Updated: October 25, 2024