Salary Overpayments

Origins

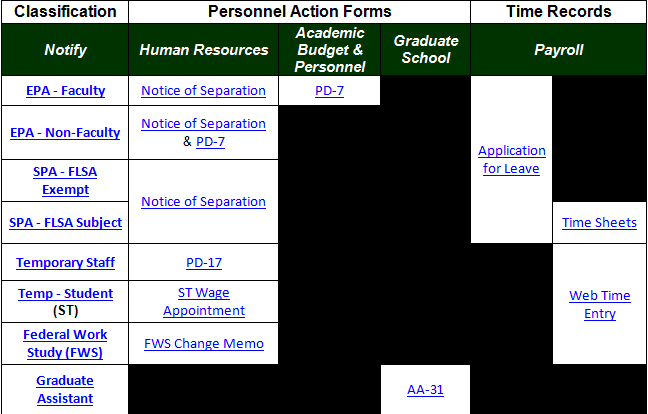

Campus divisions and departments are ultimately responsible for the accuracy and timely submission of personnel action forms including Personnel Distribution forms (PD7) and time records. Failure to do so may result in overpayments to employees, creating an unnecessary financial burden on the department.

Payroll Calendar & Due Dates: Each year, Payroll provides monthly and bi-weekly schedules for the upcoming year, including deadlines for receiving personnel action forms and time records. The Payroll Calendar is readily available on Payroll’s website.

Supervisors: All supervisors must communicate information about search postings, hiring recommendations, terminations, leaves of absence, pay rate changes, etc. to their department’s Business Officers in a timely manner. The supervisor is then responsible for ensuring that the information is submitted through the proper approval process (e.g., through the Graduate School, Office of Academic Budget & Personnel, Human Resources and/or Payroll) prior to the “Paperwork Due to Payroll” date (in Payroll Calendar). Since some of the personnel action documents must have multiple approvals before delivery to Payroll for processing, departments may need to anticipate review time or simply monitor the status of the personnel action to help prevent potential overpayments and ensure new/current employees are paid timely.

Overpayment & Collection Process

If the employing department becomes aware of a potential overpayment, Payroll should be contacted immediately, and this overpayment form must be completed. Upon notification, Payroll will:

- Gather the supporting documents and calculate the overpayment on a gross-to-net basis. The employee is only required to repay the net amount if repayment can be accomplished within the same calendar (tax) year. If repayment crosses the calendar (tax) year, the gross amount must be repaid.

- Send written notification to the employee, with a copy to the employing department, detailing the overpayment and the University’s expectation for collection. This includes notification of North Carolina General Statute 147-86.23 which outlines the University’s right to add interest & penalties to past due accounts. Effective January 1, 2015, the University will assess a one-time 10% late payment penalty and accrue interest charges at 5% annually unless payment is received or a payment plan has been agreed to by both parties within 30 days of the notification date.

- For Repayment Options: Contact Payroll (Note: Current employees will have their overpayment collected through a payroll deduction, unless other payment arrangements are made.)

Most of the time, individuals make repayment arrangements within 30 days of being notified; however,

- If Payroll has not received a response after 30 days, the overpayment is considered past due and a second communication is sent, indicating interest and penalties will begin unless repayment arrangements are made immediately.

- Students with a past due overpayment will have a registration hold placed on their account until payment is made. Once the overpayment is 30 days past due, the student will be denied readmission, transcripts, diploma, etc. until payment is made.

- If no response is received after 60 days past due, then the Controller’s Office notifies the State of North Carolina Attorney General’s (AG) Office of the debt. The AG’s office then sends a final communication to the employee for collection. The Controller’s Office will also refer the debt to the North Carolina Department of Revenue (NCDOR), under North Carolina General Statute 105A-3(b), to have it deducted from the employee’s State income tax refund according to the Set-Off Debt Collections Act (SODCA).

- If no response is received to the AG’s letter within 90 days, then the University may turn the debt over to a state-approved collection agency.

Once full repayment is received, the funds are returned to the department and updates are made to the employee’s gross pay, taxes, deductions, and benefit records. If needed, an amended Form W-2 is issued.

Contact Email: payrolldept@charlotte.edu

Last Updated: June 22, 2021