UNC Charlotte Moving Expense Procedures

Overview

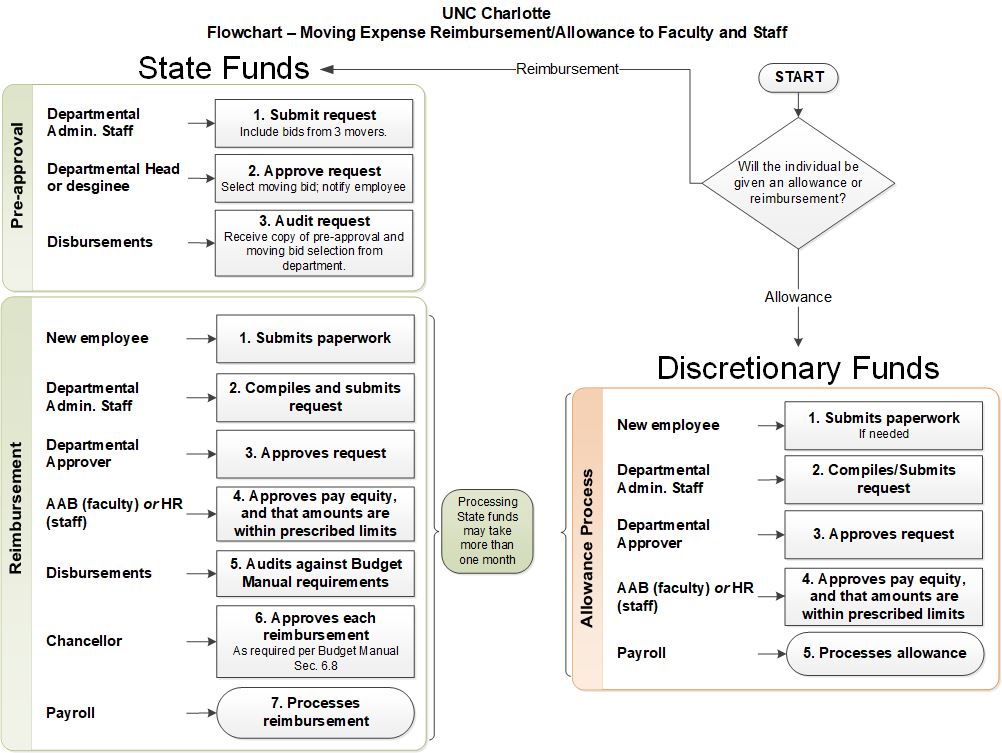

Moving expenses for new hires at UNC Charlotte can either be reimbursed using State funds or provided via an allowance using Discretionary funds. All moving support from the university is fully taxable to employees. Approval of the administrative head of the employing department is required prior to making commitments to pay moving and relocation expenses. Additional approvals may be required depending on the fund source, as described in these procedures.

ELIGIBILITY CRITERIA, FUNDING SOURCES AND ALLOWABLE AMOUNTS

Eligibility

The University may pay an employee’s moving expenses when (1) Moving reimbursement or allowances are available for full-time, permanent positions, and (2) eligible employees will be moving from outside a 100-mile radius of the Greater Charlotte area.

The employee’s move must be completed within the first year of employment. Exceptions require pre-approval, in writing, from the listed responsible individual (Senior Associate Provost for Faculty and the Executive Director of HR for Staff) before offering moving expense reimbursements or allowances to the prospective employee.

Funding Sources

The University offers two types of funds for employee moving expenses: 1) Moving reimbursements, covered by State funds, or 2) Moving allowances, covered by Discretionary funds. Only one of these two fund types may be used to pay for moving expenses for a single employee for either a reimbursement or allowance.

Moving Reimbursements (State Funds)

Typical “Moving-related expenses” covered via a moving reimbursement are outlined in detail in the North Carolina Office of State Budget and Management (OSBM) Budget Manual Sections 6.8 and 6.9 and include but are not limited to:

- Payment for movement of household and personal goods includes items such as furniture, clothing, and personal effects.

- Travel expenses incurred in moving the employee and his or her family from the old residence to the new residence are as follows:

- For locating a new residence, three (3) round trips, not exceeding six (6) days and three (3) nights, are required.

- For the day of moving – subsistence, lodging and mileage

The employee is required to submit a pre-approval request to use state funds, which requires the Chancellor’s approval. The moving reimbursement will require out-of-pocket expenses for the employee and will likely take more than one month to process.

Moving Allowances (Discretionary Funds)

Typical “Moving-related expenses” covered via a Moving Allowance include, but are not limited to, house hunting, moving truck rentals, hiring moving companies, shipping costs for household items and related supplies, storage costs before or during the move, shipping costs for household pets, mileage incurred during the move, and other move-related costs such as connecting/disconnecting utilities and temporary living arrangements.

- Typically, no supporting documentation or receipts are needed.

- However, when the allowance request is for $10,000 or more, receipts must be submitted and maintained, and the allowance will only cover the actual moving-related expenses supported by receipts.

Additional Fund Guidance

Payment for all moving-related expenses is the responsibility of the employee.

The moving expense reimbursement or allowance will be paid as a taxable lump sum payment and is intended to offset some of the employee’s moving-related costs at the hiring department’s discretion.

Departments may opt to cover applicable taxes for employees via a gross-up. Discretionary funds must be used for the gross-up portion of a reimbursement or allowance, regardless of the fund type used to cover moving expenses.

The Moving Expense Reimbursement and Allowance Forms are the only approved method for paying a moving reimbursement/allowance to an employee. Moving-related expenses cannot be paid directly to an employee or a vendor via p-card, 49er Mart, or Employee & Student Direct Pay Request (ESDPR).

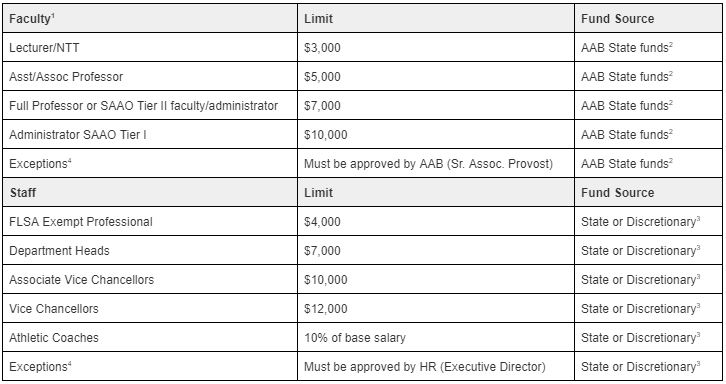

Allowable Amounts

Departments can submit a total request up to the following amounts:

- Moving expense support is not considered “special pay subject to the “3/9ths” rule for 9-month faculty.

- Academic Affairs Budget provides the funding for faculty moving expenses for all colleges/departments except for the Belk College of Business (BCOB) and The Williams States Lee College of Engineering (COEN).

- Funding for staff moving expenses is contingent upon the availability of departmental funds. Note that while HR (Human Resources) approves moving expense reimbursements/allowances for staff they do not provide any central source of funding.

- For exceptions, include the following required information: Candidate’s Name; Rank and/or Title; Any additional working title (e.g., Distinguished Scholar); Department/College; Standard Amount of Moving Support for rank; Requested Exception Amount; Reason exception is needed.

Discontinuation of Employment

Employees that leave University employment prior to 90 days must reimburse the University 100% of any allowance received (gross, not net of taxes). Should an employee voluntarily leave University employment within one year of hire for a position other than a promotion within North Carolina state government, they may be required to reimburse the University for a prorated portion of the allowance. The employee should work with the hiring department to determine the amount to be repaid. No tax withholding or reporting adjustments will be made by the Payroll Office. Repayment should be made directly to the department outside of the payroll system.

Procedures

- If using State funds, your department or college’s business support staff should complete a Pre-approval Request Form (download it before completing it).

- You can share this instruction guide with new employees that walks them through the information that is needed for the pre-approval and reimbursement.

- Attachments should be uploaded as PDFs. Do not upload attachments as zip files.

- New employees should NOT complete this form for themselves. The form and attachments follow an automated workflow for designated approvers, as detailed in the flowchart below:

Click the image below to enlarge:

Resources

Moving Expense Reimbursement Forms

- Moving Reimbursement Pre-Approval Request Form

- Moving Reimbursement Request Form

- Moving Allowance Request

Other resources

- OSBM Budget Manual Sections 6.8 and 6.9

- UNC Charlotte Moving Reimbursement Instruction Guide for new employees

Responsible Office: Controller’s Office

Contacts

- Faculty: Contact your College/Unit Business Officer

- Academic Affairs Budget: aa-budget@charlotte.edu

- Academic Affairs Personnel: aa-personnel@charlotte.edu

- Staff: Human Resources – Tiffani McCain, Director of Position and Performance Management, tmmccain2@charlotte.edu

- Financial Services

- Disbursements: travel@charlotte.edu

- Tax: taxoffice@charlotte.edu

- Payroll: PayrollDept@charlotte.edu

Created 2/18

Last Updated: May 1, 2024