Full List of Resources

Guideline for Maintaining Merchant Accounts

Purpose

The purpose of this document is to provide guidance on maintaining merchant accounts for accepting payment cards (credit and debit cards).

Scope

This guideline applies to all UNC Charlotte employees, affiliates and authorized users who will interact with payment card data, functions or systems as part of their job duties.

Contacts

Direct general questions about this guideline to the Office of the Bursar – Merchant Services at ecommerce@charlotte.edu.

Guidelines

All departments or units issued a merchant account will be required to:

- Disclose return, refund, and/or cancellation policies to the cardholder before the cardholder enters their card information for processing. Signs disclosing the policy must be clearly visible at the Point of Sale (POS) for Card Present (CP) transactions or on the website/online portal for Card Not Present (CNP) internet transactions.

- Follow the Standard for Handling Cardholder Data which includes reporting security incidents immediately.

- Reconcile transactions and settle sales electronically to the merchant services provider on a daily basis.

- Investigate and respond to disputes, retrievals, and chargebacks on a timely basis.

- Maintain adequate records of the sales transaction (i.e., daily sales totals, logs, etc.) in accordance with State record retention policies.

- Complete the EC-Merchant Agreement on an annual basis.

- Document their business processes for card processing on an annual basis or when significant changes occur to the card processing environment.

- Ensure staff meet merchant training requirements for card processing.

- Complete required Self-Assessment Questionnaires (SAQs), a reporting tool used by merchants and service providers to self-report their adherence to the Payment Card Industry Data Security Standards (PCI DSS), and associated validation documentation requirements.

- Complete required Attestation of Compliance (AOC) with PCI DSS, which declares the accuracy and truthfulness of information provided in the SAQ.

The Office of the Bursar – Merchant Services will review accounts periodically and reserves the right to close merchant accounts with extended periods of inactivity.

Related Resources

- Standard for Accepting Electronic Payments

- Standard for Handling Cardholder Data

- University Policy 605.3, Retention, Disposition, and Security of University Records

Revision History

- Initially approved by the AVC for Finance on November 25, 2024

Guideline for Outsourced Payment Processing

Purpose

The purpose of this document is to provide guidance in establishing and maintaining contracts with third party service providers that provide payment (credit/debit) card processing on behalf of UNC Charlotte or its affiliates.

Scope

This guideline applies to all University employees, affiliates and authorized users who want to utilize a third party to accept payment cards from University customers without utilizing a University merchant account.

Contacts

Direct general questions about this guideline to the Office of the Bursar – Merchant Services at ecommerce@charlotte.edu.

Guidelines

To streamline the receipt of cash according to the University’s Cash Management Plan, the preferred method of payment card acceptance is through a University-owned merchant account. However, there may be instances when it is more efficient or effective to outsource payment card processing through a third party’s merchant account and receive proceeds through another method of payment.

Before Outsourcing Payment Card Processing

- Contact Merchant Services: Prior to entering into any contract or purchasing specialized software, equipment or systems necessary for payment card processing, departments must contact the Office of the Bursar – Merchant Services. They will review customized processing applications for compliance with standards, guidelines, security measures, contract requirements and feasibility.

- Include Merchant Services in Request for Proposal (RFP): It is best practice to include the Office of the Bursar – Merchant Services in any formal RFP process involving payment acceptance.

- Third-party Service Providers: Any unit that wishes to utilize third party software that includes the outsourcing of its credit card transaction processing must request approval in writing to ecommerce@charlotte.edu and provide proof of the vendor’s Payment Card Industry Data Security Standards (PCI DSS) compliance and/or validation of payment software. It is preferred that any third party that captures Cardholder Data (CHD) utilize a validated Level 1 Service Provider. The vendor must assume full responsibility for all PCI DSS requirements and notify the University and/or its affiliates of any CHD security breaches.

- Departmental Collaboration: The Office of the Bursar – Merchant Services in conjunction with Materials Management, OneIT, the Office of Legal Affairs, the Internal Audit Department and the applicable computer support unit, will work with the department to ensure that processing standards, safeguarding measures and legal requirements are met.

- OneIT Oversight: OneIT oversees the governance of data security, use of IT systems, evaluation and recommendations of technologies, and provides direction and support for the security and networking of campus infrastructure utilized for card processing systems. Any software and IT-related acquisition request must be submitted to OneIT for review before the acquisition. OneIT will oversee the final approval, signature and execution of contracts and acquisitions involving technology.

- Additional information and Costs: Additional information or external consultation may be required. The requestor will bear all costs related to the external review if required for the approval process.

- Implementation of Approved Software/Equipment: Implement approved third-party software/equipment according to third-party guidelines. Modify default vendor passwords and settings to unique ones before installing the system on the University network or using it for card processing.

Contract Elements

Contracts and associated documentation must address these elements:

- Compliance with the OneIT Standards and Guidelines; specifically:

- Standard for Security Requirements of Information Systems, and the related Information Security Checklist

- Standard for Information Security related to Vendors and External Parties

- PCI SSC Requirements: Compliance with all appropriate Payment Card Industry Security Standards Council (PCI SSC) requirements and their responsibility for all PCI DSS requirements. If CHD is captured on the vendor’s network, they must address:

- Proof of PCI DSS compliance and/or validation of payment software

- Specifying that they will be fully responsible for all elements of the PCI DSS

- Documentation that clearly details the flow of CHD and specifies any outside entities’ applications or servers utilized

- Service level agreements

- Remote access and use of Multi Factor Authentication

- Protection of Personally Identifiable Information (PII)

- Data retention and destruction policies

- Liability

- Business continuity

A final copy of the executed contract must be emailed to the Office of the Bursar – Merchant Services at ecommerce@charlotte.edu.

Related Resources

- Standard for Accepting Electronic Payments

- Standard for Information Security related to Vendors and External Parties

- Standard for Security Requirements of Information Systems

- University’s Cash Management Plan

Revision History

- Initially approved by the AVC for Finance on November 25, 2024

Guideline for Payment Card Processing Exceptions

Purpose

The purpose of this document is to provide guidance on how to request approval for an exception to the Standard for Accepting Electronic Payments.

Scope

This guideline applies to all UNC Charlotte employees, affiliates and authorized users who will interact with payment card data, functions or systems as part of their job duties.

Contacts

Direct general questions about this guideline to the Office of the Bursar – Merchant Services at ecommerce@charlotte.edu.

Guidelines

The University does not currently store, process, or transmit Cardholder Data (CHD) on the University’s network. Therefore, any changes to the University’s CHD Environment or exceptions to the Standard for Accepting Electronic Payments must be submitted in writing to the Office of the Bursar – Merchant Services at ecommerce@charlotte.edu for consideration, and approval by both the Vice Chancellor for Business Affairs (VCBA) and Chief Information Officer (CIO).

Requests should include:

- Business reason for the exception

- Steps that will be taken to ensure compliance with Payment Card Industry Data Security Standards (PCI DSS) requirements

- The date that the exception will no longer be needed

The Office of the Bursar – Merchant Services, in conjunction with OneIT, will work with the VCBA and the CIO to review the request. The final approval or denial will be made by the VCBA or their designee.

The University prohibits the use of virtual terminals on its merchant accounts. The University no longer utilizes analog fax machines, and digital fax machines are not an acceptable method to receive mail order forms. These types of exceptions significantly change the scope of the University’s PCI DSS compliance requirements and will not be approved.

Exceptions Requiring UNC System Office Endorsement and OSC Approval

- Merchant Accounts outside the Merchant Card Master Service Agreement (MSA)

The University does not currently allow departments to open merchant accounts outside of the State’s MSA.

According to NC Policy 500.2 – Statewide Accounting Policy – Master Services Agreement for Electronic Payments, State agencies (including universities) are required to use the State’s MSA unless an exemption, endorsed by the UNC System Office, is approved by the State Controller. However, according to NC G.S. 116-40.22(e) (Management Flexibility), the University is authorized to contract with service providers specializing in services offered to institutions of higher learning that offer systems or services under arrangements that provide for the receipt of funds electronically, provided the services are in compliance with the requirements of the payment industry security standards.

Departments requesting to establish a merchant account through any other financial institutions besides the University’s merchant services provider (e.g., Fiserv) must provide a written business case to the Office of the Bursar – Merchant Services at ecommerce@charlotte.edu detailing:- Why the exception is necessary, and

- Who will be responsible for managing and supporting the new merchant account system(s)

- Exemption from the North Carolina (NC) G.S. 147-77 (Daily Deposit Act)

The University does not currently have any departmental daily deposit exemptions.

According to the NC Daily Deposit Act, all funds in the hands of any agency of the State collecting or receiving money belonging to the State of North Carolina, must deposit and record those funds with the State Treasurer, at noon, daily. However, according to NC G.S. 116-40.22(e) (Management Flexibility), the State Treasurer may exempt the applicability of the daily deposit requirement for any standard business process resulting in a delay in the University receiving the funds from a service provider, when the exemption is based upon an acceptable business case that demonstrates an overall efficiency to the University and State. Such a business case must first be endorsed by The University of North Carolina System Office before submission to the State Treasurer for consideration.

Departments requesting an exemption from the daily deposit requirement must provide a written business case to the Office of the Bursar at bursar@charlotte.edu detailing:- Why the exception is necessary, and

- How frequently money will be deposited with the State Treasurer

Related Resources

- Merchant Card Master Service Agreement

- NC G.S. 116-40.22(e) (Management Flexibility)

- NC G.S. 147-77 (Daily Deposit Act)

- NC Policy 500.2 – Statewide Accounting Policy – Master Services Agreement for Electronic Payments

- Standard for Accepting Electronic Payments

Revision History

- Initially approved by the AVC for Finance on November 25, 2024

Guideline for Telephone Order Payments

Purpose

The purpose of this document is to provide guidance in the usage of telephone order payment (credit/debit) card processing.

Scope

This guideline applies to all UNC Charlotte employees, affiliates and authorized users who will interact with payment card data, functions or systems as part of their job duties.

Contacts

Direct general questions about this guideline to the Office of the Bursar – Merchant Services at ecommerce@charlotte.edu.

Guidelines

Obtain Approval to Accept Telephone Order Payments

If the acceptance of cardholder data (CHD) via telephone order is needed for business operations, approval must be requested and obtained through the Office of the Bursar – Merchant Services. A request including business justification must be submitted to ecommerce@charlotte.edu. Any voice over IP solutions must be hosted by a third party service provider who can provide proof of Payment Card Industry Data Security Standards (PCI DSS) compliance. CHD must not interface with the University network.

Physical University Phone, or other PCI Compliant Solution, is Required

Card Not Present (CNP) payments must not be accepted over the Zoom desktop client or mobile app installed on a University device connected to the University’s network. The Zoom application is not a certified PCI compliant solution. Once approved, merchants should retain or acquire a physical Zoom phone from OneIT by contacting zoom-phone-group@charlotte.edu before accepting payments over the phone.

Personal Mobile Devices are Prohibited from Accepting Telephone Orders

CNP payments must not be accepted over personal mobile devices or the Zoom mobile app installed on a personal mobile device. Your personal mobile device is not a certified PCI compliant solution. Merchants who receive calls after-hours or off-site on a personal mobile device should direct customers to their physical Zoom phone line or send the customer a link to their secure online payment platform.

Handling Telephone Order Payments

Merchants approved to receive telephone order payments must ensure those payments are:

- Processed on approved devices as they are received (i.e., CHD should not be written down and never entered into a University device for processing later)

- Entered only by staff that have completed the merchant training requirements for card processing

Related Resources

Revision History

- Initially approved by the AVC for Finance on November 25, 2024

Guideline for Third Parties Accepting Electronic Payments on Behalf of the University or on University Property

Purpose

The purpose of this document is to provide guidance for third party merchants, including student organizations, who accept payment (credit/debit) cards on behalf of the UNC Charlotte or on University property. Adherence to this standard will help ensure that the University is doing business with third party merchants who are compliant with Payment Card Industry Data Security Standard (PCI DSS) requirements.

Scope

This guideline applies to all third parties authorized to do business on behalf of or on University property who will be interacting with payment card data, functions, or systems as part of their job duties.

Contacts

Direct general questions about this guideline to the Office of the Bursar – Merchant Services at ecommerce@charlotte.edu.

Guidelines

Obtain Prior Approval(s)

Third parties, including student organizations, may not process payment cards on behalf of the University or on University property without proof of PCI DSS compliance and prior approval from their division or college/administrative Business Officer and authorization from the Vice Chancellor for Business Affairs’ (VCBA) designee (i.e., Office of the Bursar – Merchant Services). All third parties should coordinate their activity with relevant campus merchants prior to conducting business, regardless of the method of payment.

- All student organizations must be approved by the SGA Senate and abide by the Student Organization Handbook.

- All dining or vending related activities (e.g., food trucks, delivery robots, etc.) must be approved through the food service company under contract to the University in accordance with the Food Service Policy. Visit Auxiliary Services – Catering and submit a Food Service Waiver Form.

- All transportation related activities (e.g., scooters, bike rental) must be approved through Parking and Transportation Services.

- All space reservations must be approved through the Conference, Reservations, and Event Services (CRES) Office, in accordance with the University’s Policy on Use of University Space.

- All alumni related activities should be coordinated through the Office of Alumni Engagement.

- All gifts, donations, or sponsorships must be approved through University Advancement before acceptance of those monies.

- All athletic related activities (including camps and clinics) must be approved by the Division of Athletics.

- All University-sponsored programs involving non-student minors (including athletics camps sponsored by University coaches) must report their program to the Office of Risk Management and Insurance (RMI) at least two weeks prior to the program beginning.

Card Present (CP) Transactions on Campus

Transactions must not be processed over the University’s wired or wireless network. They may only be processed on cellular devices that do not interface with the University network or over networks provided and managed by the third party.

Online Payment Processing

If a student organization website is hosted on a University server, it is prohibited from linking out for payment processing.

Externally hosted (i.e., not hosted at/or by the University) student organization web pages that include payment processing, must have a visible disclaimer readily viewable on the site stating that the site is not the University or a part of it. Please see below for an example disclaimer:

This is not a University of North Carolina at Charlotte (“University”) website. This registration and payment portal is administered by a third party payment processor (“Payment Processor”). The Payment Processor is responsible for the security and system availability of the payment portal. The University does not endorse, recommend, guarantee, control, or accept responsibility for any product or service made available by Payment Processor. The presence of a link to the Payment Processor’s website does not imply any affiliation, endorsement, approval, or verification by the University.

You understand that the Payment Processor’s website may contain terms and privacy policies that are different from the University’s terms and policies. You should review these provisions to ensure that you understand them, and to determine whether the website is suitable for you. The University does not review, and is not responsible for, these provisions.

The University will not be liable for any losses arising from or in connection with any errors or omissions with respect to payments processed by the Payment Processor, or any fees or charges imposed by the Payment Processor.

Related Resources

- Standard for Accepting Electronic Payments

- Student Organization Handbook

- University Policy 601.6, Use of University Space

- University Policy 709, Food Service Policy

Revision History

- Initially approved by the AVC for Finance on November 25, 2024

How to enroll in direct deposit

Purpose: For instructions on how to establish or change direct deposit information online, see this FAQ.

Last Updated: January 23, 2024

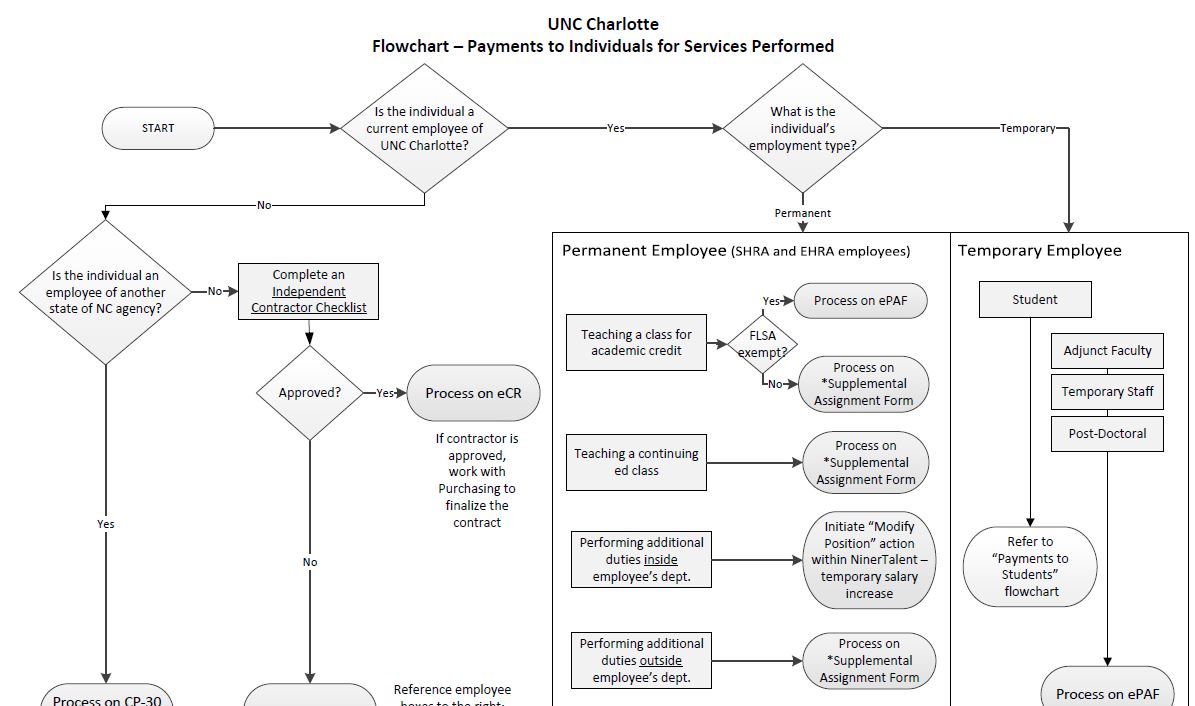

How to Pay Individuals

To request a payment to an individual, it is important to address two questions:

- What is the purpose of the payment?

- Is the individual currently employed by the University?

Click on the summarized flowchart below for additional guidance in selecting the appropriate payment method (guidance on paying students is also available):

Click the image below to enlarge:

Rationale and other considerations:

It’s important to keep in mind that the name given to the payment by the payer is not controlling. Misclassification of payments can lead to incorrect tax withholding and reporting.

Sponsored guest payments should be submitted on an Employee and Student Direct Pay Request (ESDPR).

Last Updated: September 14, 2023

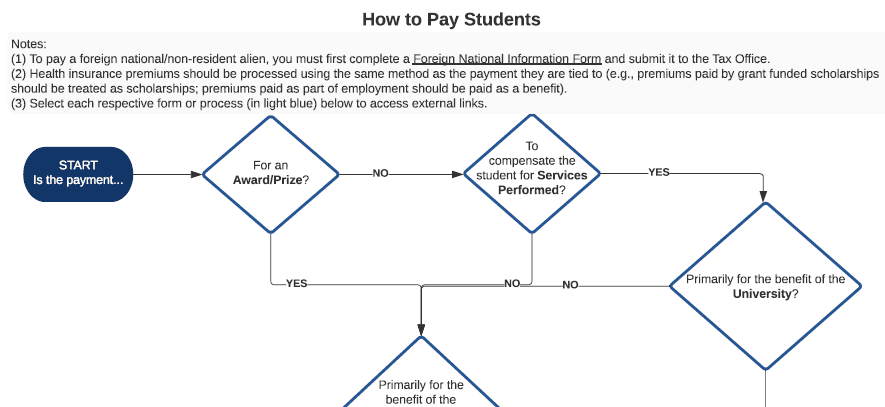

How to Pay Students

UNC Charlotte pays students for a variety of purposes. Most payments to students (besides government aid that is processed through Financial Aid) should either be classified as educational awards (namely scholarships/ fellowships) or compensation. On occasion, students will receive business expense payments (namely reimbursements or non-educational awards/prizes). Click on the summarized flowchart below for additional guidance in selecting the appropriate payment method:

Click the image below to enlarge:

Rationale and other considerations:

It’s important to keep in mind that the name given to the payment by the payer is not controlling. For example, a payment described as a “scholarship” that requires services to be performed is, in actuality, compensation and is subject to applicable payroll taxes. Misclassification of payments can lead to incorrect tax withholding and reporting.

Last updated: 10/28/16, 6/17/19, 8/13/19, 8/25/20, 10/13/21

Last Updated: October 13, 2021

How to Pay Vendors with Outgoing Wire Transfers

The Financial Transaction Request (FTR) Wire Transfer eForm can be used to generate Wire Transfer transactions when an ACH payment or check is not acceptable. It may also be used to send payment in foreign currencies. Please make sure the fund and account number(s) you are using is/are an accurate representation of the transaction. Financial Services reserves the right to correct any inaccurate account numbers.

Finance Transaction Request Info:

The Transaction Type you select is: Wire Transfer

*NOTE: The physical appearance of the FTR form will automatically change based on the Transaction Type selected. Therefore, it is important to complete this section first.

Wire Type – Choose either International for wires being sent outside of the US or Domestic for wires sent within the US.

Confirm the Dept. Approver 800#. This field is auto-populated with the 800# of the Preparer’s direct supervisor; it may be changed if a more appropriate ‘Approver’ exists. If you don’t know the 800# you can begin entering the name in the field and a list will appear to choose from.

Add Add’l Approver (Optional). If desired, click and fill-in an additional 800# to receive the transaction for approval. If you don’t know the 800# you can begin entering the name in the field and a list will appear to choose from.

Transaction Type Info:

Index/Fund & Account – Each line must be coded with a six-digit INDEX/FUND code and a six digit ACCOUNT code. To determine the Banner Fund Code use Banner form FTVFUND. To determine the Banner Account Codes use Banner form FTVACCT and consult the Expense Account Code List maintained by Reporting & Fixed Assets.

*NOTE: AN INVALID INDEX/FUND WILL INVALIDATE THE ENTIRE SUBMISSION.

Description – Each line must contain a description. The description can be up to 35 characters long.

Payment and Beneficiary Details:

Type of Currency – For International wires, choose the type of currency for the wire being sent, i.e. Euro, USD, etc.

Beneficiary Name – This is the name of the person or business receiving the wire. This must match the name on the bank account you are using.

Beneficiary Address – Please provide the address of the business or person receiving the wire.

Routing Number (for Domestic Wires) – This is the bank identifier and should be 9 numbers long.

Account Number/IBAN – For International wires, the IBAN normally begins with two letters followed by a string of numbers. Some International accounts do not use IBAN but may use just an account number.

SWIFT Number (for International Wires) – This is the bank identifier and may be just letters or a combination of letters and numbers.

Bank Name – Name of the bank receiving the wire.

Bank Address – Address of the bank receiving the wire.

Payment Explanation for Beneficiary – This should be an explanation the wire recipient will be able to use to identify the purpose of the payment. You can use an invoice number or a description such as “Registration for Math Conference for John Doe.” Some banks require a stated purpose for the wire and that may be included in this explanation.

How to find the transaction in Banner:

The transaction will appear as a book disbursement, created by General Accounting, in Banner. This is a JCD rule code and the document number will begin with the letter “D.” The wire information and backup will be attached to the book disbursement in Perceptive Content.

If this payment is related to a Travel Authorization (TA), list the book disbursement document number on your TA.

Last Updated: August 18, 2022

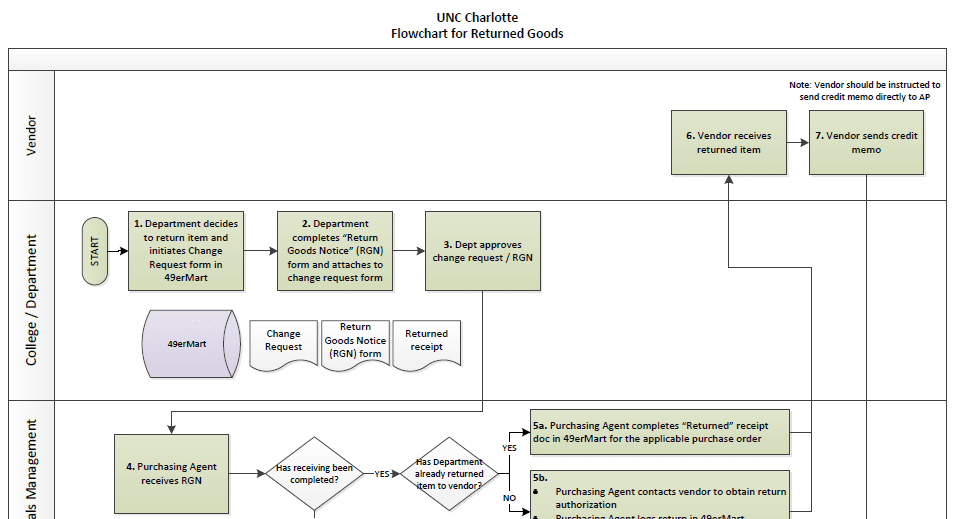

How to Return Goods

When a department needs to return an item procured through 49er Mart on a purchase order, several key steps should occur to ensure the return is properly processed. Please refer to the flowchart below for guidance on the returned goods process.

Click on the image below to enlarge:

For additional information, refer to the 49er Mart Canvas training, or contact your department’s Purchasing Agent.

Last Updated: September 14, 2018

Human Subject Payments, How to Pay

Definition

Human subject payments are defined as payments of cash (including cash equivalents/gift cards) or tangible personal property as incentives to individuals (subjects) for their participation and time commitment in a clinical trial, survey, or research study. Please refer to the Office of Research Protections and Integrity (ORPI) Human Subjects webpage for detailed requirements for research studies that involve human subjects at UNC Charlotte.

Payment Methods

49er Mart or purchasing cards (p-cards): Can be used to purchase any items of tangible personal property, such as pens, books, candy. P-cards can be used to purchase gift cards. (refer to the Gift Cards/Gift Certificates, How to Pay guide; link in the table below). Note that gift cards are considered cash equivalents. Electronic check requests (eCRs) can also be used to issue payment directly to a recipient who is not a student or employee. The recipient must be set up as a vendor before initiating the eCR.

Petty cash: May be used for payments up to $100 per individual, per study.

- To open a petty cash fund for a specific research study, complete a Petty Cash Fund Request Form, which must be approved by the Office of Research Protections and Integrity (ORPI) before being routed to the General Accounting office for approval. ORPI will confirm that cash was listed as the compensation method on the study’s approved IRB proposal.

- Petty cash for research studies must be initially funded through a non-grant fund (as grant funds cannot be used for advances, including to advance petty cash). Once the research study is complete and petty cash is no longer needed, the department must complete a Petty Cash Fund Request Form to close the fund. Once the petty cash fund is closed, any petty cash used for the research study can be reimbursed via grant funds by submitting a reimbursement request via an FTR form. For questions about this process, please contact Grants & Contracts Administration.

- Petty Cash Custodians must review the Petty Cash/Change Fund Procedures prior to receiving a petty cash fund. Note that reconciliation of funds is required to be sent to the General Accounting office on a monthly basis.

- Petty cash funds can have a maximum balance of $5,000. Any requests for more than $5,000 must be approved by the Vice Chancellor for Research or delegate and the University Controller.

- Requests for amounts greater than $250 should be sent at least five (5) business days in advance to allow time for the cash on hand to be requested.

Employee/Student Direct Pay Request (ESDPR): May be used when a check/direct deposit to an employee or student recipient is desired. Download an ESDPR form and complete according to the form instructions. Note that payments must be issued directly to the recipient; cash cannot be issued to administrative personnel for further distribution.

Rationale and Other Considerations

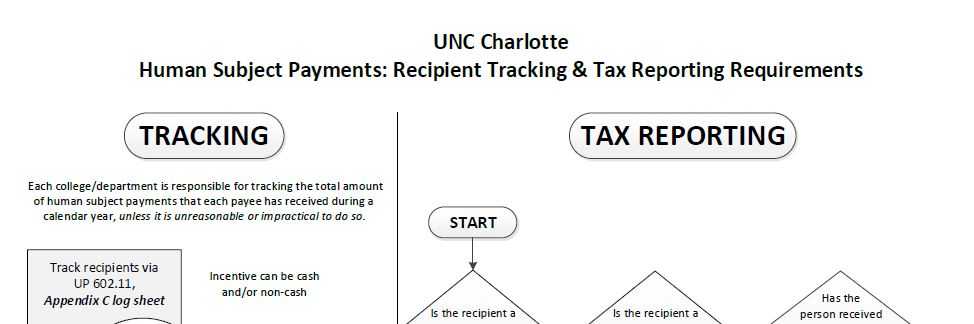

Regardless of the payment method chosen, tax reporting requirements must be met:

- Each college/department is responsible for tracking the total amount of human subject payments that each payee has received during a calendar year unless it is unreasonable or impractical to do so.

- Refer to the flowchart below for tax reporting required depending on the target study population, incentive amount, and recipient classification. Recipient classification information is also summarized below.

Click on the image below to enlarge:

Recipient classification and Tax Reporting Requirements:

- Employees: All cash incentives, including gift cards, of any amount given to employees (including student employees) are reportable on the employee’s Form W-2 and subject to federal and state income taxes.

- If UNC Charlotte employees are targeted in the research study, then any cash incentives (including gift cards) given to employees are taxable/tax reportable to the recipients as employees, regardless of amount.

- If the target study population is NOT specifically UNC Charlotte employees, nor is it advertised directly to UNC Charlotte employees by themselves, then incentives paid can be considered as unrelated to the recipient’s employment at UNC Charlotte. If the principal investigators (PI)/research administrators will not be checking recipient status (employee v. non-employee), to mitigate risk, these incentives should be limited to $100 or less. Payments are subject to the non-employee reporting requirements.

- Non-employees: If combined payments to a non-employee total $600 or greater in a calendar year, the total amount given is reportable on Form 1099-MISC reporting.

- Foreign nationals: Prior to making a payment of any amount to a foreign national/non-U.S. resident, contact the Tax Office, as tax reporting (on Form 1042-S) and withholding are required.

Quick Links

Policies

Forms

Questions?

Refer to the Tax Office and the Office of Research Protections and Integrity contacts.

Last updated: 5/02/2018, 7/30/19, 8/5/19, 7/01/21, 10/22/24

Last Updated: October 25, 2024

Imaging Document Submission (IDS) TCP Invoices eForm

Imaging Document Submission (IDS) TCP Invoices eForm

Purpose: Use this form to upload documents to a department’s drawer within the Imaging System. See the OneIT – IDS Form Submission Manual for more information.

Last Updated: April 25, 2025

Independent Contractor Checklist (ICC) Form

Independent Contractor Checklist (ICC) Form

Purpose: The ICC form is used to determine the worker classification (Independent Contractor or Employee) of a service provider. It is located in 49er Mart. Use your UNC Charlotte login credentials to access this eForm. This eForm should be completed by the department wishing to hire an independent contractor. View these FAQs for more information on the ICC.

Last Updated: November 5, 2024

Independent Contractors, How to Pay

Payment method

Choosing the appropriate method for paying an independent contractor (including the payment of an honorarium) depends on several factors. Select the appropriate payment method from the options below.

Individual – U.S. Citizen

- If the recipient is a UNC Charlotte employee, use a PD-7 / Supplemental University Employment / ePAF form

- If the recipient is an employee of another NC State agency, use a CP-30 form

- For all other recipients:

- Complete an Independent Contractor Checklist and submit it to the Tax Office

- Use an eCR (electronic check request)

Individual – Foreign National / Non-U.S. Citizen

- Ask the recipient to complete the Foreign National Information Form and the Vendor Information Form – Foreign Persons (Form W-8BEN) and submit it to the Tax Office

- Complete the Independent Contractor Checklist and submit it to the Tax Office

- Use the eCR (electronic check request)

Business

- If the business is being paid under its employer identification number (EIN), it will not be classified as an independent contractor, use 49er Mart or refer to Pay for Consulting Services

Payments to Non-NC Based Companies and Individuals for Performance-related Events

Non-wage compensation of more than $1,500 during a calendar year to a non-NC resident contractor for personal services performed in NC in connection with a performance, an entertainment or athletic event, a speech, or the creation of a film, radio or television program, is subject to NC income tax withholding at the rate of 4%. This also applies to all services performed by ITIN holders. Such payments should be requested using an electronic check request (eCR). A non-NC resident contractor is defined as an individual or business not domiciled in the state of North Carolina.

How to Process Honorariums Via eCRs

- If you are reimbursing travel expenses directly and solely related to an honorarium, you can either:

- Submit the full amount to be paid via an eCR using the Payment Type of “Honorarium.” This full amount, if $600 or more, will be subject to income tax reporting for the recipient on a Form 1099-MISC. The recipient can deduct qualified business expenses on their income tax return; they should consult their own tax advisor for guidance. — OR —

- Submit two eCRs:

- Submit the taxable honorarium amount via an eCR using the Payment Type of “Honorarium.” This amount, if $600 or more, will be subject to income tax reporting for the recipient on a Form 1099-MISC.

- Submit the reimbursement for travel expenses via an eCR using the Payment Type of “Reimbursement.” Attach a copy of the approved honorarium agreement, which will serve as authorization of the travel.

Quick Links

Procedures

Forms

- Independent Contractor Checklist (ICC) Form

- Foreign National Informational Form – Student

- Foreign National Informational – Visitor

- Employee/Student Direct Pay Request (ESDPR)

- Payroll/Personnel Action Form (PD-7)

- HR Supplemental University Employment Form

- Dual Employment – Request for additional payment for work performed for other State agency (CP-30)

Questions?

Refer to the contacts listed on the Tax Office website.

Last Updated: July 1, 2020

Individual Services Agreement Template

Purpose: This document should be used to establish an agreement between UNC Charlotte and an individual who will be providing a specialized, personal service to the University. Use this template for services involving personal, intellectual properties or talents such as photographers, artist, or performers.

Contact Email: purchasing@charlotte.edu

Last Updated: July 24, 2024

Initial Interest Form to Process Payment Cards (EC-IIF)

Initial Interest Form to Process Payment Cards (EC-IIF)

Purpose: To initiate and assess department/unit eligibility for payment card processing (e.g., credit cards) for a University-sponsored purpose. If you are interested, please complete this brief initial interest form. It will provide key information to Merchant Services, allowing them to evaluate your eligibility and determine the most suitable path forward.

Contact Email: eCommerce@charlotte.edu

Last Updated: April 30, 2025

Interdepartmental Invoice eForm

Interdepartmental Invoice eForm

This electronic form (“eform”) is to be used to transfer payments for goods/services performed for campus departments by another campus department.

Last Updated: January 11, 2021

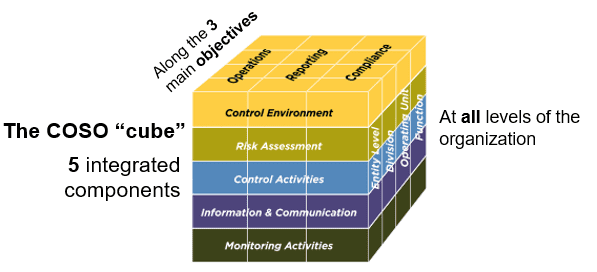

Internal Controls Training

Purpose: To provide a brief training on Internal Controls at UNC Charlotte.

Contact Wardell Kerson, Senior Accountant, for further information on internal controls.

Last Updated: April 6, 2023