Manuals, Guides, and Procedures

How to enroll in direct deposit

Purpose: For instructions on how to establish or change direct deposit information online, see this FAQ.

Last Updated: January 23, 2024

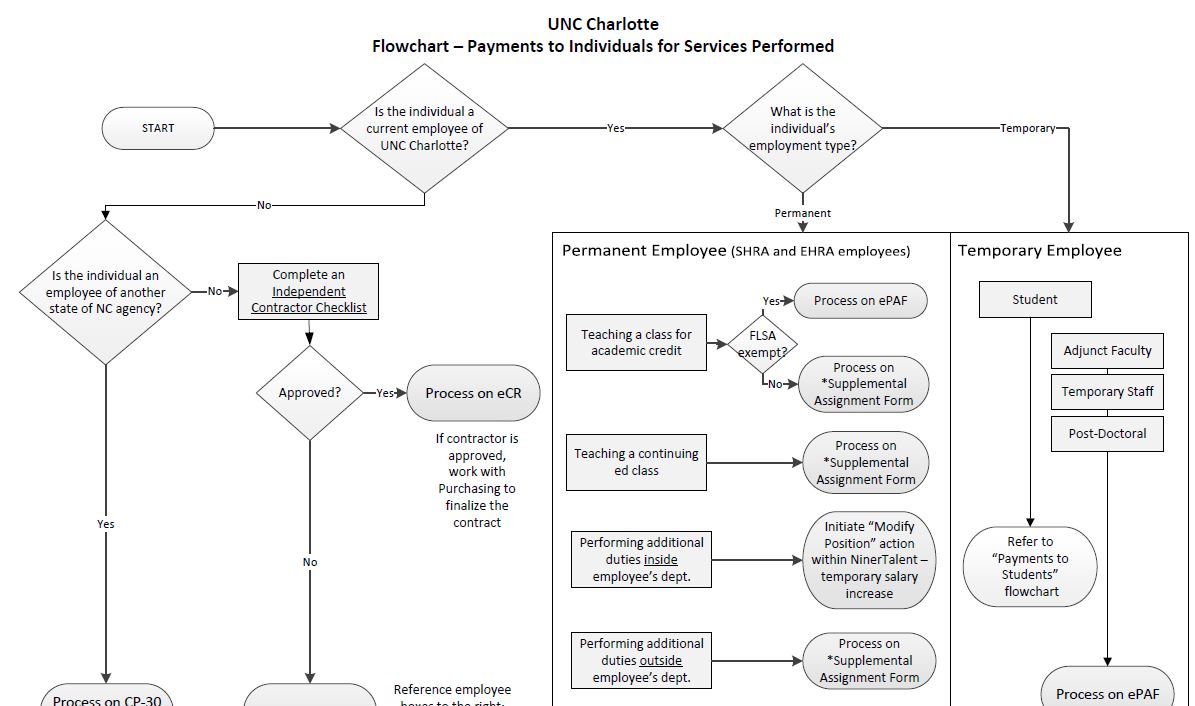

How to Pay Individuals

To request a payment to an individual, it is important to address two questions:

- What is the purpose of the payment?

- Is the individual currently employed by the University?

Click on the summarized flowchart below for additional guidance in selecting the appropriate payment method (guidance on paying students is also available):

Click the image below to enlarge:

Rationale and other considerations:

It’s important to keep in mind that the name given to the payment by the payer is not controlling. Misclassification of payments can lead to incorrect tax withholding and reporting.

Sponsored guest payments should be submitted on an Employee and Student Direct Pay Request (ESDPR).

Last Updated: September 14, 2023

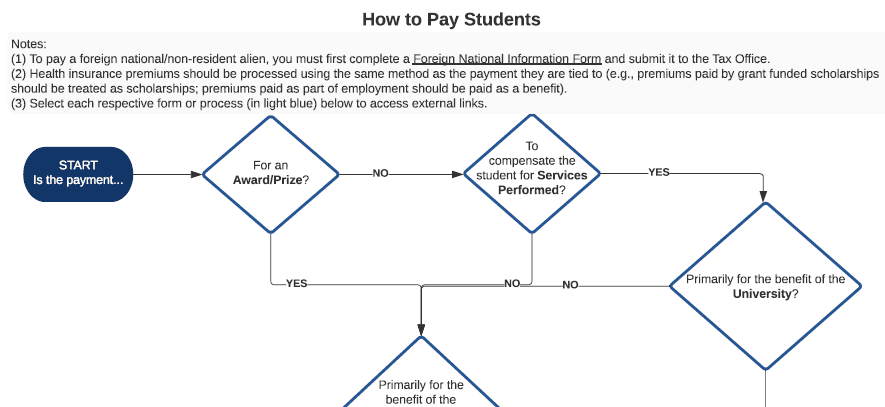

How to Pay Students

UNC Charlotte pays students for a variety of purposes. Most payments to students (besides government aid that is processed through Financial Aid) should either be classified as educational awards (namely scholarships/ fellowships) or compensation. On occasion, students will receive business expense payments (namely reimbursements or non-educational awards/prizes). Click on the summarized flowchart below for additional guidance in selecting the appropriate payment method:

Click the image below to enlarge:

Rationale and other considerations:

It’s important to keep in mind that the name given to the payment by the payer is not controlling. For example, a payment described as a “scholarship” that requires services to be performed is, in actuality, compensation and is subject to applicable payroll taxes. Misclassification of payments can lead to incorrect tax withholding and reporting.

Last updated: 10/28/16, 6/17/19, 8/13/19, 8/25/20, 10/13/21

Last Updated: October 13, 2021

How to Pay Vendors with Outgoing Wire Transfers

The Financial Transaction Request (FTR) Wire Transfer eForm can be used to generate Wire Transfer transactions when an ACH payment or check is not acceptable. It may also be used to send payment in foreign currencies. Please make sure the fund and account number(s) you are using is/are an accurate representation of the transaction. Financial Services reserves the right to correct any inaccurate account numbers.

Finance Transaction Request Info:

The Transaction Type you select is: Wire Transfer

*NOTE: The physical appearance of the FTR form will automatically change based on the Transaction Type selected. Therefore, it is important to complete this section first.

Wire Type – Choose either International for wires being sent outside of the US or Domestic for wires sent within the US.

Confirm the Dept. Approver 800#. This field is auto-populated with the 800# of the Preparer’s direct supervisor; it may be changed if a more appropriate ‘Approver’ exists. If you don’t know the 800# you can begin entering the name in the field and a list will appear to choose from.

Add Add’l Approver (Optional). If desired, click and fill-in an additional 800# to receive the transaction for approval. If you don’t know the 800# you can begin entering the name in the field and a list will appear to choose from.

Transaction Type Info:

Index/Fund & Account – Each line must be coded with a six-digit INDEX/FUND code and a six digit ACCOUNT code. To determine the Banner Fund Code use Banner form FTVFUND. To determine the Banner Account Codes use Banner form FTVACCT and consult the Expense Account Code List maintained by Reporting & Fixed Assets.

*NOTE: AN INVALID INDEX/FUND WILL INVALIDATE THE ENTIRE SUBMISSION.

Description – Each line must contain a description. The description can be up to 35 characters long.

Payment and Beneficiary Details:

Type of Currency – For International wires, choose the type of currency for the wire being sent, i.e. Euro, USD, etc.

Beneficiary Name – This is the name of the person or business receiving the wire. This must match the name on the bank account you are using.

Beneficiary Address – Please provide the address of the business or person receiving the wire.

Routing Number (for Domestic Wires) – This is the bank identifier and should be 9 numbers long.

Account Number/IBAN – For International wires, the IBAN normally begins with two letters followed by a string of numbers. Some International accounts do not use IBAN but may use just an account number.

SWIFT Number (for International Wires) – This is the bank identifier and may be just letters or a combination of letters and numbers.

Bank Name – Name of the bank receiving the wire.

Bank Address – Address of the bank receiving the wire.

Payment Explanation for Beneficiary – This should be an explanation the wire recipient will be able to use to identify the purpose of the payment. You can use an invoice number or a description such as “Registration for Math Conference for John Doe.” Some banks require a stated purpose for the wire and that may be included in this explanation.

How to find the transaction in Banner:

The transaction will appear as a book disbursement, created by General Accounting, in Banner. This is a JCD rule code and the document number will begin with the letter “D.” The wire information and backup will be attached to the book disbursement in Perceptive Content.

If this payment is related to a Travel Authorization (TA), list the book disbursement document number on your TA.

Last Updated: August 18, 2022

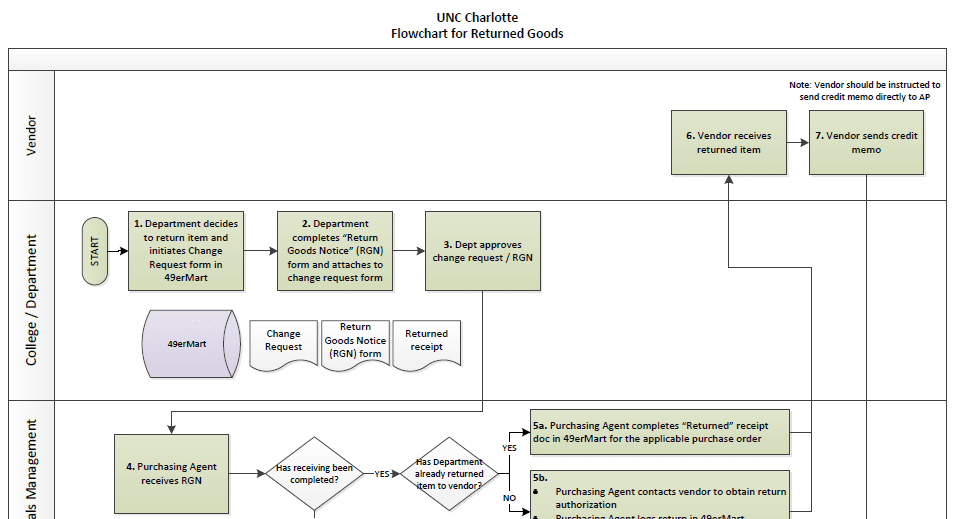

How to Return Goods

When a department needs to return an item procured through 49er Mart on a purchase order, several key steps should occur to ensure the return is properly processed. Please refer to the flowchart below for guidance on the returned goods process.

Click on the image below to enlarge:

For additional information, refer to the 49er Mart Canvas training, or contact your department’s Purchasing Agent.

Last Updated: September 14, 2018

Human Subject Payments, How to Pay

Definition

Human subject payments are defined as payments of cash (including cash equivalents/gift cards) or tangible personal property as incentives to individuals (subjects) for their participation and time commitment in a clinical trial, survey, or research study. Please refer to the Office of Research Protections and Integrity (ORPI) Human Subjects webpage for detailed requirements for research studies that involve human subjects at UNC Charlotte.

Payment Methods

49er Mart or purchasing cards (p-cards): Can be used to purchase any items of tangible personal property, such as pens, books, candy. P-cards can be used to purchase gift cards. (refer to the Gift Cards/Gift Certificates, How to Pay guide; link in the table below). Note that gift cards are considered cash equivalents. Electronic check requests (eCRs) can also be used to issue payment directly to a recipient who is not a student or employee. The recipient must be set up as a vendor before initiating the eCR.

Petty cash: May be used for payments up to $100 per individual, per study.

- To open a petty cash fund for a specific research study, complete a Petty Cash Fund Request Form, which must be approved by the Office of Research Protections and Integrity (ORPI) before being routed to the General Accounting office for approval. ORPI will confirm that cash was listed as the compensation method on the study’s approved IRB proposal.

- Petty cash for research studies must be initially funded through a non-grant fund (as grant funds cannot be used for advances, including to advance petty cash). Once the research study is complete and petty cash is no longer needed, the department must complete a Petty Cash Fund Request Form to close the fund. Once the petty cash fund is closed, any petty cash used for the research study can be reimbursed via grant funds by submitting a reimbursement request via an FTR form. For questions about this process, please contact Grants & Contracts Administration.

- Petty Cash Custodians must review the Petty Cash/Change Fund Procedures prior to receiving a petty cash fund. Note that reconciliation of funds is required to be sent to the General Accounting office on a monthly basis.

- Petty cash funds can have a maximum balance of $5,000. Any requests for more than $5,000 must be approved by the Vice Chancellor for Research or delegate and the University Controller.

- Requests for amounts greater than $250 should be sent at least five (5) business days in advance to allow time for the cash on hand to be requested.

Employee/Student Direct Pay Request (ESDPR): May be used when a check/direct deposit to an employee or student recipient is desired. Download an ESDPR form and complete according to the form instructions. Note that payments must be issued directly to the recipient; cash cannot be issued to administrative personnel for further distribution.

Rationale and Other Considerations

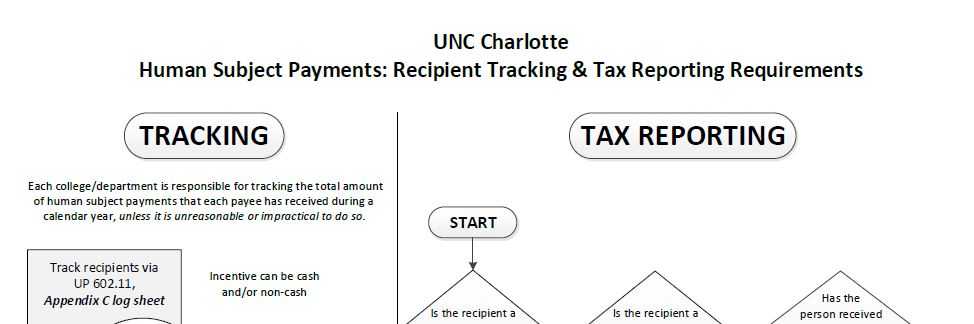

Regardless of the payment method chosen, tax reporting requirements must be met:

- Each college/department is responsible for tracking the total amount of human subject payments that each payee has received during a calendar year unless it is unreasonable or impractical to do so.

- Refer to the flowchart below for tax reporting required depending on the target study population, incentive amount, and recipient classification. Recipient classification information is also summarized below.

Click on the image below to enlarge:

Recipient classification and Tax Reporting Requirements:

- Employees: All cash incentives, including gift cards, of any amount given to employees (including student employees) are reportable on the employee’s Form W-2 and subject to federal and state income taxes.

- If UNC Charlotte employees are targeted in the research study, then any cash incentives (including gift cards) given to employees are taxable/tax reportable to the recipients as employees, regardless of amount.

- If the target study population is NOT specifically UNC Charlotte employees, nor is it advertised directly to UNC Charlotte employees by themselves, then incentives paid can be considered as unrelated to the recipient’s employment at UNC Charlotte. If the principal investigators (PI)/research administrators will not be checking recipient status (employee v. non-employee), to mitigate risk, these incentives should be limited to $100 or less. Payments are subject to the non-employee reporting requirements.

- Non-employees: If combined payments to a non-employee total $600 or greater in a calendar year, the total amount given is reportable on Form 1099-MISC reporting.

- Foreign nationals: Prior to making a payment of any amount to a foreign national/non-U.S. resident, contact the Tax Office, as tax reporting (on Form 1042-S) and withholding are required.

Quick Links

Policies

Forms

Questions?

Refer to the Tax Office and the Office of Research Protections and Integrity contacts.

Last updated: 5/02/2018, 7/30/19, 8/5/19, 7/01/21, 10/22/24

Last Updated: October 25, 2024

Independent Contractors, How to Pay

Payment method

Choosing the appropriate method for paying an independent contractor (including the payment of an honorarium) depends on several factors. Select the appropriate payment method from the options below.

Individual – U.S. Citizen

- If the recipient is a UNC Charlotte employee, use a PD-7 / Supplemental University Employment / ePAF form

- If the recipient is an employee of another NC State agency, use a CP-30 form

- For all other recipients:

- Complete an Independent Contractor Checklist and submit it to the Tax Office

- Use an eCR (electronic check request)

Individual – Foreign National / Non-U.S. Citizen

- Ask the recipient to complete the Foreign National Information Form and the Vendor Information Form – Foreign Persons (Form W-8BEN) and submit it to the Tax Office

- Complete the Independent Contractor Checklist and submit it to the Tax Office

- Use the eCR (electronic check request)

Business

- If the business is being paid under its employer identification number (EIN), it will not be classified as an independent contractor, use 49er Mart or refer to Pay for Consulting Services

Payments to Non-NC Based Companies and Individuals for Performance-related Events

Non-wage compensation of more than $1,500 during a calendar year to a non-NC resident contractor for personal services performed in NC in connection with a performance, an entertainment or athletic event, a speech, or the creation of a film, radio or television program, is subject to NC income tax withholding at the rate of 4%. This also applies to all services performed by ITIN holders. Such payments should be requested using an electronic check request (eCR). A non-NC resident contractor is defined as an individual or business not domiciled in the state of North Carolina.

How to Process Honorariums Via eCRs

- If you are reimbursing travel expenses directly and solely related to an honorarium, you can either:

- Submit the full amount to be paid via an eCR using the Payment Type of “Honorarium.” This full amount, if $600 or more, will be subject to income tax reporting for the recipient on a Form 1099-MISC. The recipient can deduct qualified business expenses on their income tax return; they should consult their own tax advisor for guidance. — OR —

- Submit two eCRs:

- Submit the taxable honorarium amount via an eCR using the Payment Type of “Honorarium.” This amount, if $600 or more, will be subject to income tax reporting for the recipient on a Form 1099-MISC.

- Submit the reimbursement for travel expenses via an eCR using the Payment Type of “Reimbursement.” Attach a copy of the approved honorarium agreement, which will serve as authorization of the travel.

Quick Links

Procedures

Forms

- Independent Contractor Checklist (ICC) Form

- Foreign National Informational Form – Student

- Foreign National Informational – Visitor

- Employee/Student Direct Pay Request (ESDPR)

- Payroll/Personnel Action Form (PD-7)

- HR Supplemental University Employment Form

- Dual Employment – Request for additional payment for work performed for other State agency (CP-30)

Questions?

Refer to the contacts listed on the Tax Office website.

Last Updated: July 1, 2020

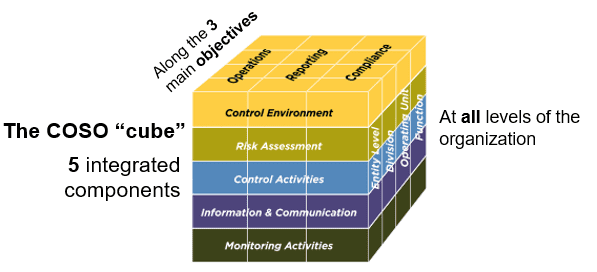

Internal Controls Training

Purpose: To provide a brief training on Internal Controls at UNC Charlotte.

Contact Wardell Kerson, Senior Accountant, for further information on internal controls.

Last Updated: April 6, 2023

International Tax Compliance Training

Purpose: Provide the slide deck related to the tax compliance portion of the departmental instructor-led training co-presented by the Tax Office, HR and the International Student and Scholar Office (ISSO). This training is for departments that hire international employees. See the Financial Services Professional Development and Training Materials page for all finance training opportunities.

Last Updated: April 8, 2025

Inventory Coordinators List

Purpose: Provide a list of Inventory Coordinators by Level organizational code.

Last Updated: See date in workbook tab

Merchant Training Requirements

Overview

As part of UNC Charlotte’s PCI Compliance program (payment card security), all merchants that accept card information as a form of payment through point of sale, web, phone, or paper form are required to maintain compliance with the Payment Card Industry Data Security Standard (PCI DSS) to continue to accept payment cards on behalf of the University or its affiliated entities.

Merchant Training

Merchant Training is required under PCI DSS and the University’s Standard for Accepting Electronic Payments for all employees interacting with payment card data, functions, or systems (e.g., credit and debit cards) as part of their job duties. This training is now available on demand as employees are hired and/or change their role, and will be reassigned annually on February 15, as required under PCI DSS.

- Complete the Merchant Training request form to request this training for you or your employees. Once assigned, you will receive a separate email notification with more detailed instructions. You will have 30 days to complete the training through the Learning & Development Portal. Reminder notices will be sent to you and your supervisor closer to the due date.

- This training now includes information for individuals responsible for recording daily Payment Book Receipts. Email cashiersoffice@charlotte.edu if you have any questions about submitting your deposit.

IT Security Training

IT Security Training is also an important supplement to merchant training offered through the Learning & Development Portal. It is recommended that employees complete this training prior to interacting with payment card data, functions, or systems (e.g., credit and debit cards) as part of their job duties. This training is required for all University employees and will be reassigned annually in September.

- Guidance for accessing the training is located on the OneIT Information Security Education webpage and the University FAQ site.

Contact Email: eCommerce@charlotte.edu

Last Updated: March 14, 2025

Municipal Advisor Letter

Purpose: The municipal advisor letter serves as a certificate of representation between UNC Charlotte, its affiliated entities, and their retention of a municipal advisor. We are represented and will rely on our municipal advisor to provide advice concerning the issuance of municipal securities, investment of bond proceeds, escrow investments, and other financial services needs. Once a new municipal advisor is assigned, an updated letter will be made public on this page.

Last Updated: October 28, 2024

Obtaining and Using a UNC Charlotte Receipt Book

Obtaining a receipt book

- Please complete the form to request a Receipt Book. Once the Cashiers within the Office of the Bursar receive your request, they will email you and let you know when your book is ready for pick up. Please allow up to 24 hours for them to log your information and reply.

- You must be full-time faculty or staff to request a book and you must bring your employee ID card with you to pick up your book. Employee’s are responsible for this book until it is checked back into the Office of the Bursar.

depositing information

The Daily Deposit and Reporting Law (G.S. 147-77) require the depositing of all funds on a daily basis and to report the same on a daily basis. An exemption may be granted provided the funds to be deposited do not exceed $5,000.00 and that they are deposited at least once per week. For additional information, see University Policy 602.4.

using the receipt book

A receipt must be written when receiving payment in cash. The receipt book consists of three copies. The top receipt should be given to the payee, the middle copy should stay with the department and the third copy stays in the book for cashier reconciliation purposes. You will need to bring this book to the Office of the Bursar each time you make a deposit. On the deposit form you should indicate the starting receipt and the last receipt included in the deposit. The cashier will add these receipts to make sure they balance with the deposit form and initial, date, and write down the Banner receipt number on the last receipt.

If you should need to void a receipt please write VOID in big letters across the receipt and all three copies MUST remain in the book. If the top copy has already been torn out, please staple or tape it back in.

When your event is over or all receipts have been used (whichever is first) please return the book back to the Office of the Bursar after all your deposits have been made. The cashier will sign it back in.

**If your receipt book is lost, we will notify the business manager/department head and inform them that you will no longer be able to collect monies on behalf of the department until the receipt book is found.**

If you have any questions regarding these procedures please email the Office of the Bursar at bursar@charlotte.edu.

Last Updated: June 14, 2024

Out-of-State Employees Guidance

UNC Charlotte Strategy: physical location of workforce

- UNC Charlotte has a strong preference for a North Carolina workforce. Hiring preference should be given to employees living and working in-state when all other factors are equal.

- As a North Carolina entity, UNC Charlotte has a responsibility to provide NC public sector jobs when possible.

- This applies to students, including graduate assistants, and temporary employees.

- At this time, a workforce abroad should be avoided if possible, considering the direct and indirect costs of compliance.

- Restrictions:

- Term: Out-of-state arrangements must be temporary in nature. Terms are limited to one year. Renewals must be approved annually.

- Multiple jurisdictions: UNC Charlotte cannot accommodate withholding prorated income taxes for more than one state in a single pay period.

- IT Security: Employees must use University-managed devices when working remotely.

Definition of Out-of-State Employee

An employee who will be located outside the state of North Carolina when performing work for UNC Charlotte. Examples:

- A part-time faculty member teaching online classes 100% remotely outside of North Carolina.

- A full-time faculty member on paid leave residing out of state and working on grant activity for UNC Charlotte.

Procedures

If a potential need arises for an employee to complete work for UNC Charlotte from a non-NC jurisdiction for more than one month, complete the relevant form linked below at least 60 days prior to the proposed start date of the arrangement. All approvals as indicated on the form must be obtained.

- For staff: Employee Dashboard and Telework/Remote Work Request Form

Once approved, it will be forwarded to Financial Services - For faculty: Faculty Duty Station Attestation Form

The form is not needed if:

- the duration of the work to be completed outside of NC is for one (1) month or less; or

- the employee will not be doing work for UNC Charlotte while outside of NC (e.g., employee is on leave, or employee is part of a faculty exchange program)

potential costs

- Pass-through costs (e.g., state-specific benefits) may apply to individual employees or their hiring departments.

- Costs are incurred every time the University must set up to withhold income taxes and set up unemployment insurance in other states. To check if the University is already set up in a specific state, contact the Tax Office.

- Out-of-country employment requires contracted service with a professional employer organization (PEO). Estimated additional cost is 40-60% of the employee’s salary.

Background

Almost all states require employers to withhold tax from wages earned in that state. To maintain a lawful out-of-state or international employee, UNC Charlotte must comply with requirements that vary by jurisdiction and include:

- Employer registration

- Employment and wage laws, including minimum wage and required pay frequency

- Income tax withholding

- Other taxes/withholding (e.g., disability, paid family leave, local jurisdiction requirements, required benefits)

- Monthly/quarterly/year end reporting

- New hire reporting

- Unemployment insurance (UI)

- Workers’ compensation

Resources

- AA-43: Faculty Duty Station Attestation Form

- Employee Dashboard and Telework/Remote Work Request Form for SHRA and EHRA Non-Faculty Employees

- UNC System Office Regulation 300.8.6[R] on Flexible Work Arrangements and Remote Work

- University Policy: UP 101.22, Flexible Work & Telework Arrangements for SHRA and EHRA Non-Faculty Employees

- Flexible Arrangement FAQs

Contacts

- For tax withholding questions, contact the Tax Office

- For faculty teleworking questions, contact Academic Budget & HR

- For questions about staff telework/remote work arrangements, email Employee Engagement and Retention at hrengagement@charlotte.edu

Created February 2019

Rev. 3/5/19, 6/11/19, 10/4/19, 11/06/20, 3/18/21, 4/09/21, 7/01/21, 12/02/22, 10/09/25

Last Updated: October 9, 2025

Overview of Travel (Videos)

Click play for an Overview of Travel Rules for State Employees provided by the North Carolina Office of State Budget and Management (NC OSBM).

Click play for an Overview of Travel Reimbursement for State Employees provided by the NC OSBM.

UNC Charlotte specific travel guidance and forms for faculty and staff are available on the Financial Services Travel webpage.

Contact Email: travel@charlotte.edu

Last Updated: September 30, 2022

Payroll Calendar

Purpose: Add and view the University’s Google payroll calendar by selecting the payroll calendar link. Detailed instructions are available on the University FAQ site.

Contact Email: PayrollDept@charlotte.edu

Last Updated: January 23, 2024

Petty Cash/Change Fund Procedures

Procedures for Petty Cash and Change Fund at UNC Charlotte.

Last Updated: February 7, 2022

Pilferable Equipment Template

Purpose: This template is an example of how to maintain important information about assets that are at risk of theft. Examples of pilferable equipment each department is required to maintain include laptops, computers, data projectors and other pilferable items with an acquisition cost between $1,000 and $5,000. Departments are strongly encouraged to track pilferable equipment with an acquisition cost under $1,000. Reference this FAQ for more details.

Contact: fixedassets@charlotte.edu

Last updated: October 24, 2025